Imagine waking up to discover your social media account or banking application compromised in the blink of an eye. Digital platforms have become part of our everyday routine—sometimes, all it takes is one weak password—or none at all—for your private life to be upended. That’s why knowing the importance of security online is crucial for everyone, from techie millennials to busy parents keeping track of online payments. Let’s take a look at a few simple but powerful steps to help keep your personal information—along with your online security—protected, especially now that your privacy is only as strong as your weakest password.

Why a Strong Password Matters More Than Ever

Nearly everyone in the Philippines is connected these days. Over 85 percent of the population is online regularly. When your favorite apps or websites ask for a password, your decision carries real impact. Recent incidents—like the widespread leak exposing 16 billion passwords—remind us just how dangerous a careless mistake can be. Think of your password as the key to your house. Using something basic—like "123456" or your birthday—can seriously put you at risk. Instead, always combine uppercase letters, numbers, and special symbols for stronger security.

Password Managers: Your Digital Memory Aid

With so many accounts to handle, it’s tempting to reuse passwords or jot them down on your phone. But that isn’t safe. Password managers are tools that generate and store unique passwords for all your accounts, keeping them secure. They’ll even help you make passwords you don’t need to memorize. Look for a provider with solid reviews and strong encryption. Many Filipinos trust proven options like LastPass or Bitwarden—both offer free plans and mobile apps, perfect for busy people on the go.

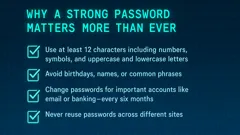

Checklist: Building a Secure Password Strategy

- Use at least 12 characters including numbers, symbols, and a mix of uppercase and lowercase letters.

- Avoid birthdays, names, or common phrases.

- Change passwords for important accounts like email or banking—every six months.

- Never reuse passwords across different sites.

- Choose a password manager for added convenience and security.

"A breach can happen to anyone, anywhere. If a data breach happens to you soon, your digital protection is only as strong as your password and your backup security layer."

Why Two-Factor Authentication Is a Must-Have

Even the toughest passwords can still be cracked. This is why two-factor authentication (2FA) is a game-changer. With 2FA, you’ll need to enter a code (usually sent to your phone) along with your password to get into your account. It’s like having an extra guard dog protecting your door. Most Filipino banking, shopping, and email services already offer 2FA. Turn it on whenever you can—it’s worth it for the added protection.

Real-Life Risks: Price of Neglecting Security

In Manila and other cities, stories of scams and hacked accounts are sadly normal. From simple password guessing to full-blown phishing, the impact can be severe—lost money, stolen identities, and a lot of stress. Shockingly, over 60 percent of Filipinos surveyed admit to using weak or repeat passwords. Taking a few extra minutes to strengthen your online security can save you years of financial trouble and emotional distress down the road.

Keep Your Digital Life Safe in the Philippines

Don’t let negligence put your personal info at risk. Good passwords and two-factor authentication aren’t just buzzwords—they’re your main defense against account hacks and data leaks. Remember those news headlines about the huge security breach? That’s real life, not just a warning. Not sure how to craft a super-secure online banking password? It’s easier than you think—and could be the smartest move you make.

Meg Magazine

Meg Magazine

Comments